Quick Facts

- Torsten Reil, co-CEO of Europe’s most valuable defense startup Helsing valued at €12 billion, warned that defense tech is experiencing a bubble at Bloomberg Tech Summit in London

- The German AI defense company executive predicts 80 percent of European defense startups will fail despite hundreds of drone companies launching across the continent

- Helsing raised €600 million Series D in June 2025 led by Spotify CEO Daniel Ek’s Prima Materia, bringing total capital raised to €1.37 billion since founding in 2021

- Reil attributes the bubble to inexperienced crypto investors pivoting into defense without understanding procurement complexities, security clearances, and export laws

- The warning comes as European defense spending exceeds €170 billion annually, with NATO’s Innovation Fund allocating €1 billion specifically for defense technology ventures

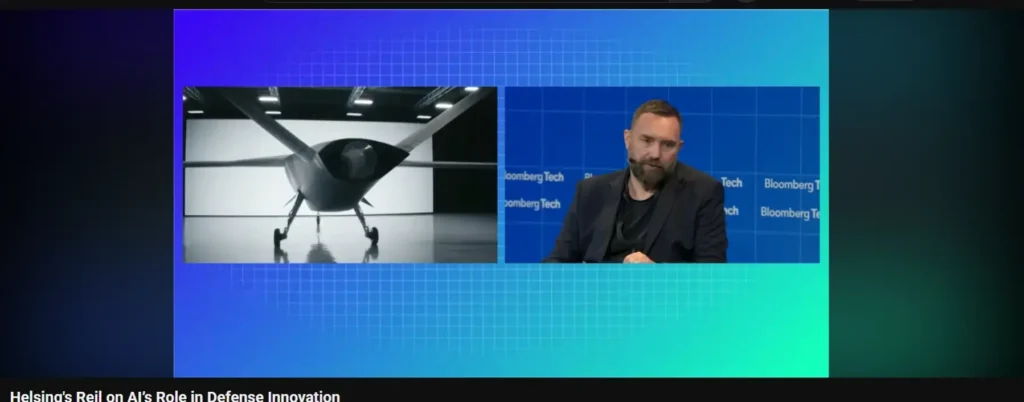

- Helsing currently produces autonomous drones and AI systems deployed in Ukraine, with partnerships spanning Saab, Airbus, and multiple European militaries for fighter jet integration

Inside the Move

The bubble emerged after Russia’s 2022 Ukraine invasion transformed defense from an investment taboo into a hot sector, attracting venture capitalists who previously avoided military technology entirely.

Reil emphasizes that product market fit represents only a small fraction of defense success, while most new entrants lack institutional knowledge around lengthy government procurement cycles and stringent compliance requirements.

Supply chain resilience poses particular challenges for mass production scaling, especially when systems require rare earth components and must transition from building hundreds of units to manufacturing tens of thousands.

Helsing differentiates itself through full-stack integration combining software AI with hardware manufacturing, evidenced by its June 2025 acquisition of German aircraft maker Grob Aircraft for indigenous production capability.

The consolidation warning arrives as established defense primes maintain structural advantages over startups in navigating complex security architectures, though Helsing positions itself as a partner rather than disruptor to traditional contractors.

Momentum Tracker

🔺 Helsing strengthens market position as consolidation looms, leveraging €12 billion valuation and operational deployment in Ukraine to attract government contracts while competitors struggle with procurement barriers

🔻 Crypto-funded defense startups face mounting pressure as institutional investors recognize defense requires decade-long relationship building and regulatory expertise beyond typical venture capital muscle memory